Why is Yacht Registration a Big Deal?

Considering an international yacht registration may offer advantage to the yacht and the yacht owner. Yacht buyers have the option to register and title their yacht in different countries. With larger yachts, many owners choose to register the yacht ‘offshore’ or ‘foreign flag’ for various reasons. This article provides information as to the benefits (and issues) of international yacht registration with a foreign flag.

Have you ever wondered what the term ‘not for sale in US waters to US residents’ means? It shows up a lot on certain yacht advertisements. See below for an explanation of this term.

Every Country Has Different Rules and Laws Regarding Yacht Registrations

Every country next to an ocean has different policies regarding the ability for yachts to enter their country and cruise. When a yacht first enters a designated port of entry, the captain and crew must undergo immigration formalities and customs. Once this is processed, the yacht is issued a ‘cruising permit or license’. This allows the yacht to cruise the country’s waters for a specific period of time before either a renewal or export.

All countries offer treaties with each other which recognize the reciprocal ability for various other countries to have cruising permits issued. For instance, the US has treaties with a number of countries which allows certain yacht registration to cruise freely with a cruising permit, but not others. Thus yachts belonging to owners in countries which do not have a reciprocal treaty with the US (such as Mexico believe it or not!) can have a yacht registration in other countries and obtain the cruising permit. Common foreign yacht registration in the US include St. Vincent and the Grenadines, British Virgin Islands, Cayman Islands, Jamaica and the Marshall Islands.

US Yacht Owners Occasionally Register in Different Countries

It is not unusual for even US owners to flag the yacht in a foreign country, even to cruise in US waters. It made sense a few years ago for US owners to use an international yacht registration in order to avoid paying state sales tax and US duty (even though US duty is very low at 1.5%). However, a 20 million dollar yacht would pay roughly $300,000 for US duty.

A special note is that US duty is lost if the US registry is ever changed to a foreign registry….which is likely the case with other countries.

However with the introduction of a tax repeal in Florida, whereby yachts have a sales tax cap of $18,000, the benefits are reduced and more yachts are returning to a US yacht registration.

- Other reasons for US owners of large yachts to use an international yacht registration include the ability to employ foreign crew (which often work for less and not allowed under a US yacht registration). Foreign yacht registration may also benefit from better liability and asset protection.

- Some owners intend to cruise in waters where a US flag is not as beneficial as other registries – such as any ‘red flag’ (countries which were once or still are British such as BVI or Cayman Islands) – giving further reason for an international yacht registration.

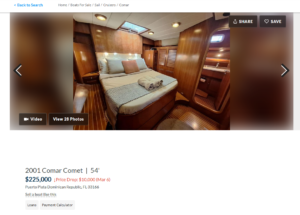

Selling a Foreign Yacht in the USA

Yacht owners should note that there are some restrictions to being able to sell a yacht which carries an international yacht registration in the US. One of the provisions of the cruising permit is that the yacht cannot be offered for sale while in US waters. Thus a common disclaimer is often seen – “not for sale to US residents while in US waters”. This means that the owner has an international yacht registration and has not paid US duty. In order to sell the yacht in the US, a foreign yacht registration needs to pay US duty. This is a one time event and can be transferred from owner to owner if done properly. However, the owner cannot use the yacht personally while it is for sale.

Of recent note, there are havens in South Florida which are Duty Free Yachting Zones including Sea Gardens Marina in Miami, Pier 66, Bahia Mar and Lauderdale Marine Center in Fort Lauderdale. Specific rules apply, however yachts docked in these zones may offer the yacht to anyone with no restrictions.

Furthermore, the state of Florida mandates that a foreign registered yacht must be in the care and custody of a licensed Florida yacht broker or the owner might be forced to pay use tax.

US Laws for Ownership

While US law does not allow foreign owners to document a vessel (see Yacht Registrations: USA), a foreign citizen has the option to do the following:

- Register and title the vessel in another country and operate under a cruising permit. Note that the vessel must be ‘exported’ and ‘imported’ once per year. Most yachts with international registrations in this region go to the Bahamas and back.

- Form a corporation or similar entity with the majority shareholder being a US citizen and USCG document the boat.

- Obtain a title from a US state such as Delaware. Note that foreign owners are restricted in the ability to move the boat freely between US jurisdictions. As a warning, Delaware registries with foreign owners are becoming problematic with regards to Homeland Security.

Tax and Duty Responsibilities for Yachts

International yacht owners are often concerned about import duty when registering and bringing the vessel into their home country, as many countries outside of the US have a substantial duty and taxation for luxury goods such as yachts.

- For instance, Canada has a substantial tax when a Canadian citizen and Canadian registered yacht arrives in Canadian waters, but do not collect this tax until the vessel actually enters their waters. Thus Canadian flagged boats can cruise and operate in the US without tax implications (but must carry a cruising permit).

- European owners are especially wary of the tax implications as the VAT (value added tax) is very substantial when operating in EU waters and there are a variety of different strategies commonly employed to circumvent the VAT payment (thus often a disclaimer of ‘No VAT paid’ on yacht listings).

- Note that most countries who enforce a substantial luxury taxation policy with yachts look very closely at the ‘beneficial owner’ (even when incorporated in a foreign country) to determine whether or not a domestic citizen is liable for taxation. Penalties can be quite severe including the yacht asset being seized by the associated government (including the US).

Given the variety of circumstances, it is always a good idea to employ the services of a maritime attorney or specialized yacht duty broker who can advise and perfect the best documentation and registry for a vessel. Some documentation companies in the US can also handle foreign registries. A knowledgeable yacht broker can assist and recommend good choices and options for the yacht buyer.

For more information on US rules for yachts entering the waters of the US, please note the following link for Homeland Security Pleasure Boating Requirements.

Contact Andy Kniffin, President of Ak Yachts for more information and assistance with all your yachting needs! (954) 292-0629, andy@akyachts.com